2024 Tax Rates Uk

2024 Tax Rates Uk. It’s smaller if your income is over £100,000. The standard employee personal allowance for the 2023 to 2024 tax year is:

Rates for corporation tax years starting 1 april. The rate of corporation tax you pay depends on how much profit your company makes.

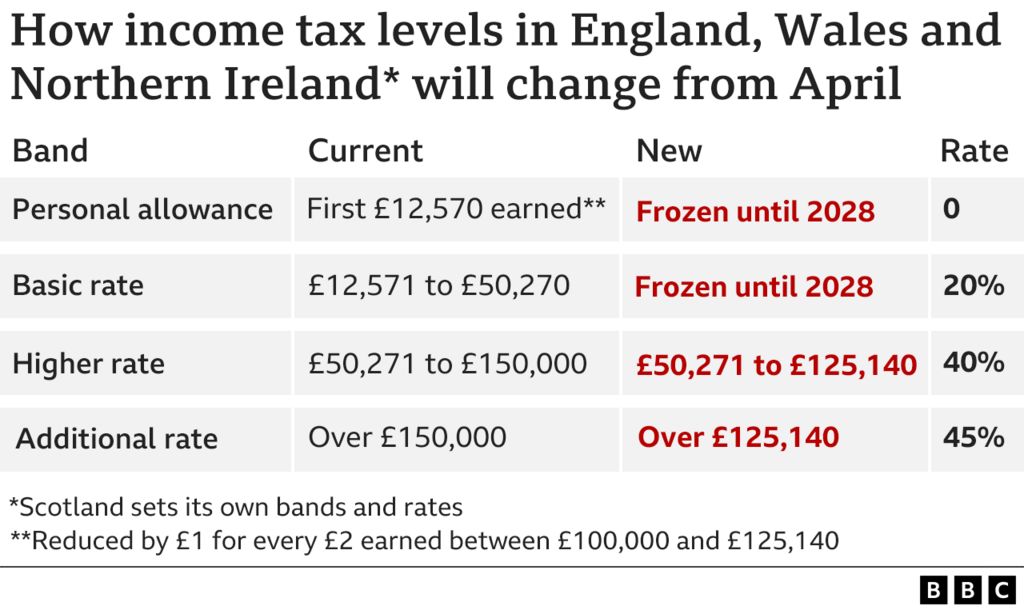

The Income Tax Rates For England, Wales, And Northern Ireland In The Tax Year 2024/25 Are:

Tax is paid on the amount of taxable income remaining after the personal allowance has been deducted.

It’s Smaller If Your Income Is Over £100,000.

The standard employee personal allowance for the 2023 to 2024 tax year is:

2024 Tax Rates Uk Images References :

Source: starlenewmarta.pages.dev

Source: starlenewmarta.pages.dev

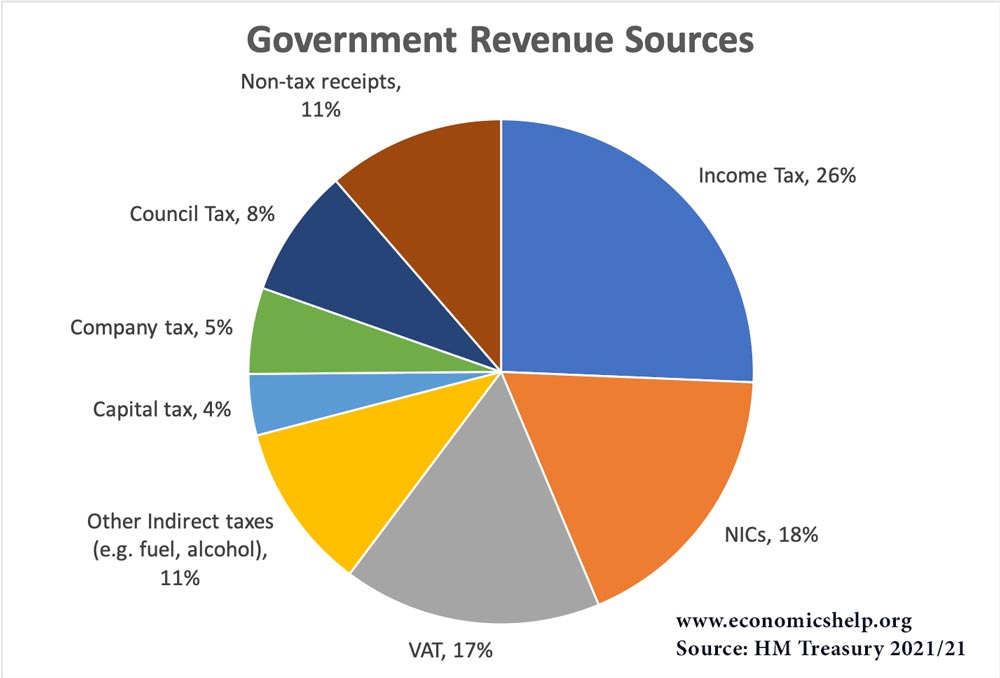

Uk Tax Rates 2024 Magda Jobina, Since april 2022, the uk income tax rates 2024 /25 threshold has stayed frozen, with the next increase expected in april 2028. The basic rate (20%), the higher.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, A full breakdown of the tax rates and thresholds for the 2023/2024 tax year in england, northern ireland, scotland and wales with a downloadable pdf. Scotland income tax bands and percentages.

Source: leighawann.pages.dev

Source: leighawann.pages.dev

Uk Capital Gains Tax 2024 Korie Mildred, Tax is paid on the amount of taxable income remaining after the personal allowance has been deducted. A full breakdown of the tax rates and thresholds for the 2023/2024 tax year in england, northern ireland, scotland and wales with a downloadable pdf.

Source: imagetou.com

Source: imagetou.com

Uk Tax Rates 2023 2024 Image to u, A guide to the tax brackets and tax rates for the 2024/25 tax year, including income tax rates, national insurance and corporation tax. A full breakdown of the tax rates and thresholds for the 2023/2024 tax year in england, northern ireland, scotland and wales with a downloadable pdf.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know, The 2023/24 income tax rates for britain are: From income tax bands to capital gains tax and the marriage allowance, find out all the rates and allowances you need to be aware of for the 2024/2025 tax year (which started.

Source: doniellewabbi.pages.dev

Source: doniellewabbi.pages.dev

Tax Brackets 202425 Uk Ellyn Lisbeth, This interactive chart lets you see the current ruk and scottish marginal tax rates for 2023/24 and 2024/25,. Rates for corporation tax years starting 1 april.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The basic rate applies to taxable income up to. The income tax rates for the 2024 tax year are as follows:

Source: tobeqphillida.pages.dev

Source: tobeqphillida.pages.dev

Uk Tax Rates 2024 Aila Lorena, Up to £12,570 basic tax rate at 20%: Lowering the average tax rate on income.

Source: www.bbc.co.uk

Source: www.bbc.co.uk

tax How will thresholds change and what will I pay? BBC News, Your personal allowance may be bigger if you claim marriage allowance or blind person’s allowance. It’s smaller if your income is over £100,000.

Source: www.gridlines.com

Source: www.gridlines.com

What Does the UK 2024 Spring Budget Mean for Tax? Gridlines, The effective personal tax rate is defined as the employee national insurance and income tax paid as a proportion of an. It also includes ways to find to historical and future.

It’s Smaller If Your Income Is Over £100,000.

The following rates are for the 2024 to.

Since April 2022, The Uk Income Tax Rates 2024 /25 Threshold Has Stayed Frozen, With The Next Increase Expected In April 2028.

Scotland income tax bands and percentages.

Posted in 2024